Elder Financial Abuse: What Every Family Needs to Know

Each day at First Utah Bank, we have the privilege of serving some remarkable people, many of whom are seniors who’ve built strong legacies in Utah. They’ve raised families, built successful businesses, and contributed to longstanding communities throughout the state. These are the kind of folks who understand the value of hard work. They also face a growing threat that most people never see coming, from financial exploitation by the very people they trust most.

A problem that often goes undiscovered

A problem that often goes undiscovered

The statistics surrounding elder financial abuse are eye-opening. Seniors in the U.S. lose a combined $28.3 billion annually to financial exploitation and abuse. This represents decades of careful saving and hard work — money that seniors often can’t afford to lose and may never be able to replace.

What makes this even more devastating is that most cases go unreported. Currently, only 1 in every 24 cases is reported and addressed by authorities. To give you an idea of what that number represents, in just one year alone, financial institutions filed over 155,000 suspicious activity reports involving elder exploitation.

Beyond the financial impact, there’s a human cost that’s even more significant. Seniors who experience financial abuse are three times more likely to suffer serious health consequences than those who haven’t been victimized. When someone steals a senior’s life savings, they’re not just taking money – they’re taking away security, independence and peace of mind that took a lifetime to build.

How it often starts

Financial exploitation of seniors takes many forms, often beginning with small, seemingly innocent requests that gradually escalate into complete financial control. Unlike the stereotypical image of a stranger targeting elderly victims, approximately 60 percent of elder abusers are family members. These are typically adult children or spouses who exploit their position of trust.

“The hardest part of our job is when we have to tell a longtime customer that someone they trusted has been stealing from them,” says Amy Foulks EVP, Chief Operating Officer at First Utah Bank. “The reality is that most of the elder abuse cases we encounter involve someone the victim knows personally.”

The most common types of fraud

![]() Family-related exploitation: Sometimes it starts with a little bit of genuine help managing finances, then gradually crosses boundaries. An adult child might start by assisting with bill payments, then begin using their parent’s credit cards for personal expenses or pressuring them to change estate documents.

Family-related exploitation: Sometimes it starts with a little bit of genuine help managing finances, then gradually crosses boundaries. An adult child might start by assisting with bill payments, then begin using their parent’s credit cards for personal expenses or pressuring them to change estate documents.

![]() Caregiver abuse: Home health workers, housekeepers, or other service providers might abuse their access by stealing cash, forging checks, or manipulating vulnerable seniors into making inappropriate “gifts” or loans.

Caregiver abuse: Home health workers, housekeepers, or other service providers might abuse their access by stealing cash, forging checks, or manipulating vulnerable seniors into making inappropriate “gifts” or loans.

![]() Romance scams: These schemes typically target lonely seniors, involving criminals who create fake identities and spend months building emotional relationships, before requesting money for fabricated emergencies or investment opportunities.

Romance scams: These schemes typically target lonely seniors, involving criminals who create fake identities and spend months building emotional relationships, before requesting money for fabricated emergencies or investment opportunities.

![]() Technology-based fraud: Scammers who exploit seniors’ unfamiliarity with digital systems, calling about fake computer problems that require immediate payment or remote access to “fix” non-existent issues.

Technology-based fraud: Scammers who exploit seniors’ unfamiliarity with digital systems, calling about fake computer problems that require immediate payment or remote access to “fix” non-existent issues.

![]() Investment fraud: Unethical financial professionals who sell inappropriate products or charge excessive fees to seniors – who may not fully understand the implications of their decisions.

Investment fraud: Unethical financial professionals who sell inappropriate products or charge excessive fees to seniors – who may not fully understand the implications of their decisions.

Why seniors become vulnerable

There are lots of reasons why older adults make for attractive targets for financial predators, though we should be clear that none of these factors are the seniors’ fault.

There are lots of reasons why older adults make for attractive targets for financial predators, though we should be clear that none of these factors are the seniors’ fault.

Many seniors have accumulated substantial assets through decades of working and saving. They often own their homes outright, maintain healthy retirement accounts, and they have excellent credit histories. Seniors also tend to be more trusting. They grew up in communities where people knew each other well, and business was often conducted based on handshakes.

Normal aging can sometimes affect judgment and decision-making abilities, making it more difficult to quickly process complex information or recognize high-pressure sales tactics. And when seniors lose spouses, friends or family members, they may become more receptive to anyone who shows them attention and kindness, even if those individuals have ulterior motives.

5 steps families can take to prevent elder financial abuse

Preventing elder financial abuse starts with families taking proactive steps, and these don’t have to be complicated or invasive.

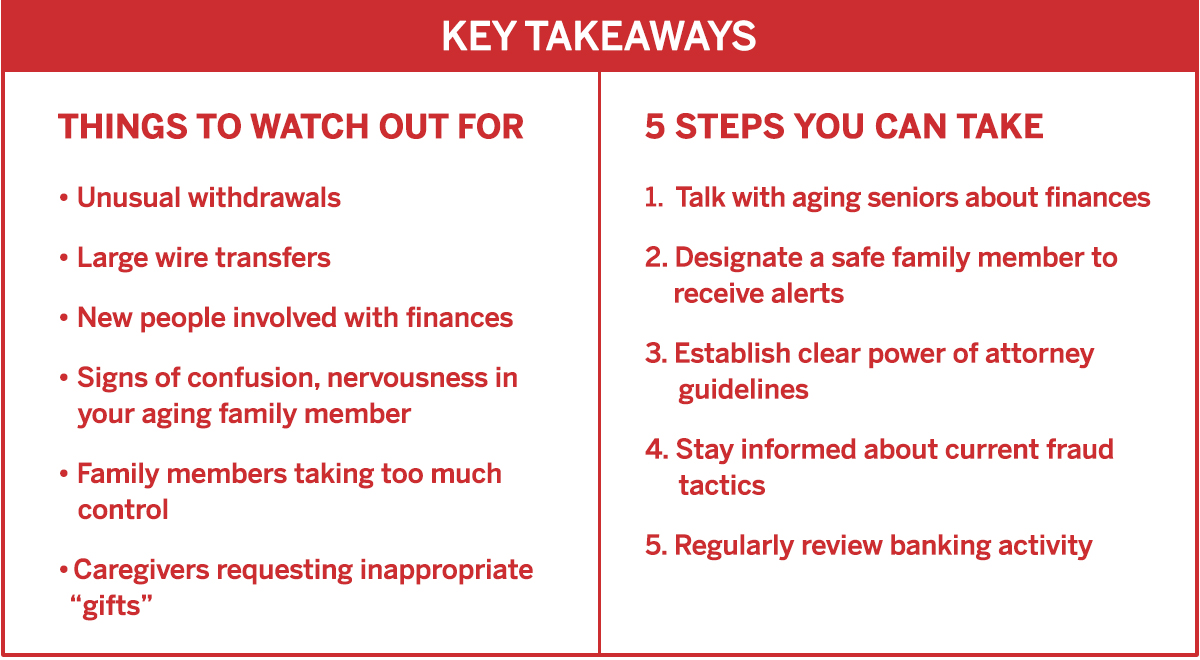

1. Maintain open communication: Have regular conversations about finances to help establish what’s normal so you can identify problems early.

2. Establish trusted contacts: Designate a family member for banking alerts on unusual account activity.

3. Plan legal protections carefully: Carefully structure power of attorney safeguards with the right person, and establish clear guidelines about their authority and limitations.

4. Stay informed about current scams: Fraudsters are always developing new tactics. Stay educated on evolving schemes and talk with seniors about them.

5. Monitor financial records regularly: Review bank statements, credit reports and account activity every month to catch problems before they become major issues.

Responding when problems arise

If you suspect elder financial abuse is occurring, swift action is vital when it comes to limiting damage and preserving evidence.

If you suspect elder financial abuse is occurring, swift action is vital when it comes to limiting damage and preserving evidence.

Don’t hesitate to contact multiple agencies immediately. Call your local law enforcement, Adult Protective Services, financial institutions, and the National Elder Fraud Hotline at 833-372-8311. Each organization plays a different role in investigation and resolution.

Document everything you observe or discover. Keep detailed records of suspicious transactions, conversations with the potential victim, and any evidence of manipulation or pressure. This documentation is important for both criminal prosecution and civil recovery efforts.

Work with your bank to implement immediate protective measures. You can place holds on accounts, flag unusual transactions, or require additional authorization for large withdrawals while investigations are moving forward.

Most importantly, be patient and compassionate. Many seniors feel embarrassed or ashamed when financial abuse occurs. They need support and understanding, not judgment or blame.

How community banks make a difference

At First Utah Bank, our relationship-based approach puts us in a useful position to help protect our customers. Because we truly know our customers personally, we tend to notice when something seems unusual or wrong.

At First Utah Bank, our relationship-based approach puts us in a useful position to help protect our customers. Because we truly know our customers personally, we tend to notice when something seems unusual or wrong.

When a longtime customer who typically makes small, predictable transactions suddenly requests a large wire transfer to an unfamiliar recipient, our trained staff knows to ask thoughtful questions. Our team is specifically trained to recognize potential warning signs, like customers who seem confused or nervous about recent transactions, or a new person who’s suddenly accompanying a senior customer into the bank.

We also monitor for account activity patterns that may signal an underlying problem, like unusual withdrawal amounts or frequencies, ATM transactions by customers who have never used electronic banking, new payees appearing on checks, or sudden changes in automatic payment arrangements.

“As a community bank, we’ve learned that sometimes the most important thing we can do is ask, ‘Are you sure about this transaction?’” says Foulks.

Building stronger community protection

At First Utah Bank, our commitment to our local community means we’re genuinely invested in the long-term wellbeing of everyone we serve. And our seniors have earned the right to age with dignity, security and confidence. Sometimes protecting them means having difficult conversations about suspicious activities, or questioning transactions that don’t seem appropriate. These conversations aren’t always comfortable, but they’re necessary and important.

At First Utah Bank, our commitment to our local community means we’re genuinely invested in the long-term wellbeing of everyone we serve. And our seniors have earned the right to age with dignity, security and confidence. Sometimes protecting them means having difficult conversations about suspicious activities, or questioning transactions that don’t seem appropriate. These conversations aren’t always comfortable, but they’re necessary and important.

“We’d rather have an awkward conversation with a customer about a suspicious transaction than let them become a victim of fraud,” says Foulks. “It’s all about building relationships strong enough that customers feel comfortable coming to us when something doesn’t feel right.”

If you have questions about elder financial protection or want to discuss security features for your accounts, contact First Utah Bank today. Our experienced team is here to help you navigate financial decisions with confidence and security. To report abuse, neglect, or financial exploitation of a senior citizen, visit Utah’s Division of Aging & Adult Services online.