Savvy Tips for Greater Financial Independence

For most people, money can be intimidating. From balancing checkbooks to understanding investment options, the world of personal finance often feels like it’s designed to confuse us. But here’s the good news — financial literacy isn’t about becoming a Wall Street expert. It’s about gaining the knowledge you need to make confident decisions about your money, and it’s more accessible than you might think.

What is financial literacy and why do you need it?

Think of financial literacy as your personal money roadmap. It’s understanding how money works in everyday life – from how to create a budget that actually works to knowing when that “too good to be true” credit card offer really is too good to be true.

Why does this matter? When you understand how money works, you’re in the driver’s seat of your financial life. The Global Financial Literacy Excellence Center found that people with stronger financial knowledge experience less money-related stress and anxiety. This makes a lot of sense. When you know what you’re doing with your money, you worry less about it.

Financial literacy helps you manage your day-to-day expenses while also preparing you for the future. It empowers you to build emergency savings for unexpected expenses (like that surprise car repair), plan for major life events, and work toward a comfortable retirement. Instead of money controlling your life, you control your money.

The state of financial literacy: revealing statistics

Feeling confused about money? You’re not the only one. Only about one-third of Americans can correctly answer basic financial literacy questions. These types of questions ask for basic knowledge, for example: “If you have $100 in a savings account earning 2% interest, how much would you have after 5 years?”

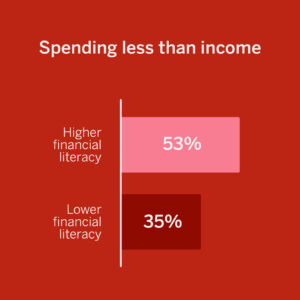

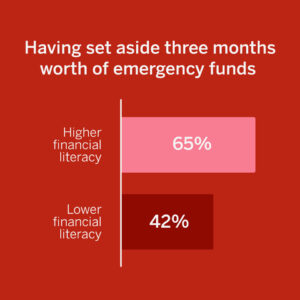

This knowledge gap isn’t just a statistic, it has real impacts on people’s lives. On the flip side, people with higher financial literacy (scoring above the median on a seven-question financial literacy quiz) are more likely to make ends meet than those with lower financial literacy. They are more likely to have emergency funds and a plan for retirement.

This knowledge gap isn’t just a statistic, it has real impacts on people’s lives. On the flip side, people with higher financial literacy (scoring above the median on a seven-question financial literacy quiz) are more likely to make ends meet than those with lower financial literacy. They are more likely to have emergency funds and a plan for retirement.

According to the Council for Economic Education (CEE), 12 states have added financial literacy curriculum requirements since 2022. This growth reflects the increased recognition of financial education’s importance at both individual and policy levels.

Learning the basic terms and vocabulary

The language of finance can sometimes make the process of learning even more confusing, so before you dig into the details, start by getting familiar with a few key terms:

Budgeting:

- Income: Money you receive through work, investments or other sources

- Expenses: Money you spend on goods and services

- Fixed expenses: Regular payments that remain constant (rent, mortgage, car payment)

- Variable expenses: Costs that change month to month (groceries, utilities, entertainment)

Credit:

- Credit score: A number representing your creditworthiness based on your credit history

- Interest: The cost of borrowing money, expressed as a percentage

- Principal: The original amount of money borrowed or invested

- APR (Annual Percentage Rate): The yearly interest rate on a loan including fees

Saving and Investing:

- Emergency fund: Money set aside for unexpected expenses

- Compound interest: Interest earned on both principal and previously earned interest

- Diversification: Spreading investments across various assets to reduce risk

- 401(k)/IRA: Tax-advantaged retirement savings accounts

Setting financial goals and creating a plan

Start by identifying what you want to achieve financially, both in the near term and further down the road. Maybe you want to build an emergency fund, save for a down payment on a home, pay off student loans, or boost your retirement savings. Whatever your aspirations, make them concrete and measurable.

Start by identifying what you want to achieve financially, both in the near term and further down the road. Maybe you want to build an emergency fund, save for a down payment on a home, pay off student loans, or boost your retirement savings. Whatever your aspirations, make them concrete and measurable.

For instance, rather than saying “I want to save more,” think about being more specific. “I will save $6,000 for an emergency fund by setting aside $500 monthly for the next year.” You want to develop a clear roadmap with achievable milestones along the way.

Short-term goals might be reachable within a year, like saving for a vacation or building a starter emergency fund. Medium-term goals typically span one to five years, like saving for a down payment or paying off a significant debt. Long-term goals stretch beyond five years, like retirement planning.

Remember, financial plans aren’t set in stone. As your life circumstances change, your financial plan should evolve accordingly. Schedule regular reviews of your progress and be prepared to adjust your approach as needed.

How to talk to your kids about money

One of the greatest gifts you can give your children is financial literacy, and it’s never too early to start.

One of the greatest gifts you can give your children is financial literacy, and it’s never too early to start.

For young children between ages 3-8, keep this kind of education simple and concrete. Use a trip to the grocery store as a learning opportunity. Explain how you make choices between similar products or why you might choose a store brand over a name brand. A clear piggy bank lets children literally see their savings grow, creating a powerful visual connection to the concept of saving.

As children reach preteen years (ages 9-12), you can introduce more complex concepts. Opening a savings account provides a real-world introduction to banking. Discussing the difference between needs and wants helps develop critical thinking about spending. Allowing children to earn money through age-appropriate chores connects effort with reward.

With teenagers, expand the conversation to include topics they’ll soon face in adulthood. Discuss how credit works, the importance of building a good credit history, and how loans work. Connect these themes with their interests and goals, like how financial choices might affect their ability to attend college, travel, or pursue other dreams.

Practical budgeting advice

A budget is simply a plan for your money — tracking income and expenses to create guidelines for spending and saving. Here’s how to develop a budget that’s attuned to your needs:

- Track your current spending: Before making changes, understand where your money is currently going. Track all of your expenses for at least a month, categorizing each purchase.

- Categorize expenses as “needs” vs. “wants”: Necessities include housing, food, utilities and transportation. Be honest about which expenses are truly essential.

- Create a flexible framework: Rather than initiating an overly restrictive budget, develop a framework that guides your decision making while allowing for some flexibility. There is a popular 50/30/20 rule that suggests allocating 50% of your income to needs, 30% to your wants, and 20% to savings and debt repayment.

- Use technology: There are many budgeting apps available that can automatically categorize your expenses and track your spending patterns, making the process even more manageable.

- Review and adjust regularly: A budget should evolve as your income, expenses and goals change. Get in the habit of reviewing your plan monthly to help keep your budget relevant and effective.

Smart saving strategies

Saving money isn’t just about having discipline – it’s about creating systems that make saving natural and automatic. Here’s how you can strategically save over time:

- Start with an emergency fund: Aim to save 3-6 months of essential expenses in an easily accessible account.

- Automate your savings: Set up automatic transfers from your checking to your savings accounts on payday. This “pay yourself first” approach ensures saving happens before discretionary spending.

- Take advantage of employer matches: If your employer offers a retirement plan with matching contributions, contribute at least enough to get the full match. It’s essentially free money.

- Consider multiple savings vehicles: Different goals require different approaches. High-yield savings accounts work well for short-term goals, while investment accounts may be better for long-term objectives.

- Harness the power of compound interest: Starting early, even with small amounts, can lead to significant growth over time. For example, at a 12.8% annualized rate of return (the stock market’s performance over the past decade), investing just $200 monthly from age 20 to 62 could grow to approximately $3.3 million.

- Look for opportunities to increase savings: Regularly review subscriptions and services to eliminate those you don’t use or need. Consider negotiating bills or shopping for better rates on insurance and other recurring expenses.

Your financial literacy journey

Financial literacy isn’t just a destination that you reach once and then stop. It’s a journey of continuous learning and adaptation. As the financial world evolves, so will your knowledge and strategies. And as you grow and develop as an individual, the demands on your understanding will also transform.

For instance, a small business owner would need to develop a higher degree of financial literacy to navigate new challenges. By familiarizing yourself with fundamental concepts, setting meaningful goals, budgeting thoughtfully, saving consistently, and passing these skills to the next generation, you can build a foundation for lasting financial well-being.

Remember, financial literacy isn’t about becoming perfect with money. It’s about becoming more confident and capable with each decision. Start where you are, use the resources available to you, and take one step at a time. Your future self will thank you for the financial wisdom you’re developing today.

Free resources for financial education

Interested in learning more? Visit these trusted sources for good financial advice:

Money Smart for Adults | FDIC.gov

Money Smart for Young People | FDIC.gov

Money Smart for Young Adults | FDIC.gov

Money Smart for Older Adults | FDIC.gov

Financial Literacy Month Resources | Utah Office of State Treasurer