Get 1% cash back on everything, no limit!

Issuing key employees company credit cards can be an effective way to streamline your company’s process for managing expenses. One important benefit is the reduction or elimination of the need for reimbursement paperwork. That’s because with a company credit card, approved purchases are easily monitored and attributed to the correct expense category. Credit cards also streamline the purchasing process by enabling your employees to facilitate purchases for your business within limited spending limits. Whether it’s paying vendors, purchasing office supplies, or making travel arrangements like booking flights and hotels (corporate Travel & Expense), an employee credit card simplifies the process. Compare the benefits and we think you’ll agree that First Utah Banks’ Visa® Credit Card is one of the best tools for helping you grow your business.

Business Credit Card Features

Cash Back |

1.00% Cash Back – no limit. All purchases are eligible. Cash back is automatically credited quarterly (15th day of the month following quarter end) |

Purchases/Balance Transfers |

13.49% APR* |

Cash Advances |

19.49% APR* |

Annual Fee |

$0.00 |

Card billing cycle date |

1st of the month** |

# of grace days |

25 |

Transaction Fees

Balance Transfer Fee |

3% |

Cash Advance Fee |

3% with $10.00 minimum |

Foreign Transaction Fee |

1% of the US dollar amount |

Late Payment Fee |

$29 |

Returned Payment Fee |

$29 |

Over Limit Fee |

$29 |

Card Replacement Fee |

$10 |

Business Credit Card Features

Cash Back |

1.00% Cash Back – no limit. All purchases are eligible. Cash back is automatically credited quarterly (15th day of the month following quarter end) |

Purchases/Balance Transfers |

13.49% APR* |

Cash Advances |

19.49% APR* |

Annual Fee |

$0.00 |

Card billing cycle date |

1st of the month** |

# of grace days |

25 |

Transaction Fees

Balance Transfer Fee |

3% |

Cash Advance Fee |

3% with $10.00 minimum |

Foreign Transaction Fee |

1% of the US dollar amount |

Late Payment Fee |

$29 |

Returned Payment Fee |

$29 |

Over Limit Fee |

$29 |

Card Replacement Fee |

$10 |

* = Annual Percentage Rate ** = Cards do not have to be paid to zero monthly

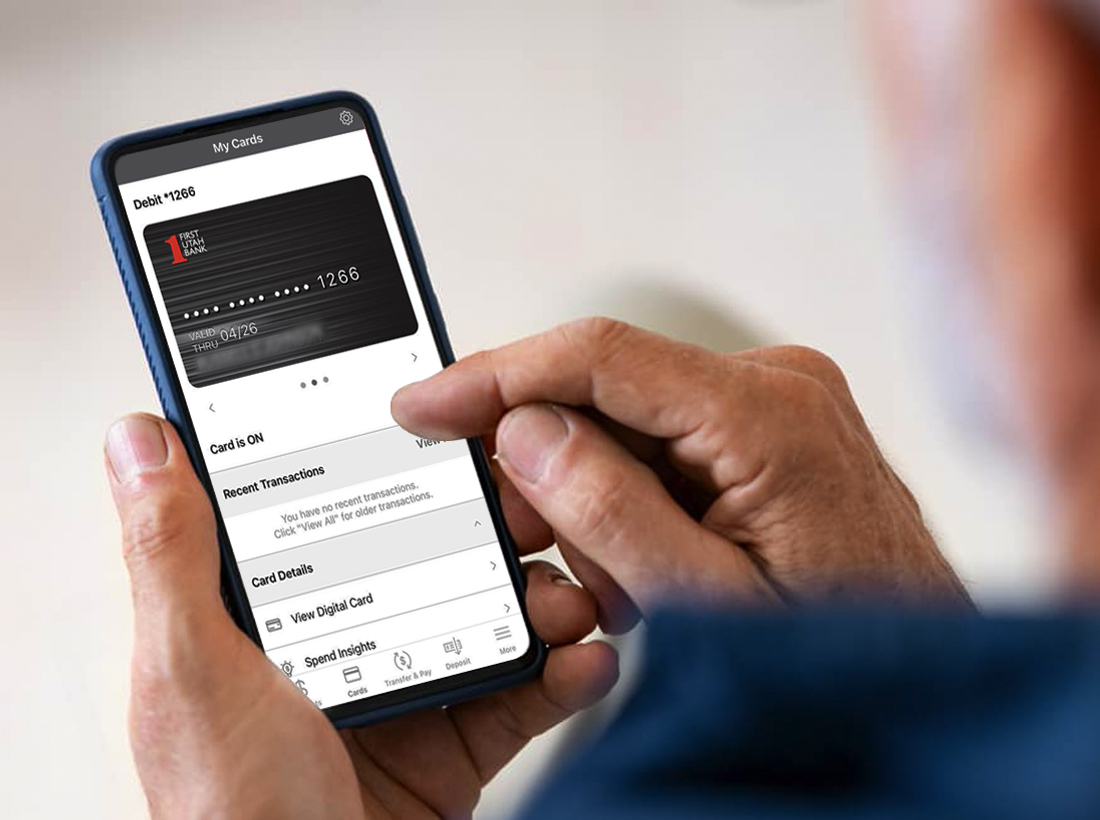

More Control over business spending

We give you full control over the administration of your Visa® Credit Card card program via our Mobile Banking app, including the ability to:

- Temporarily turn the card off (if the card is misplaced, lost, etc.)

- Securely view/use digital card for online purchases (without having to have the plastic card nearby)

- Keep tabs of all merchants where card is stored on file for convenient one-time payments, recurring charges, or ad-hoc future purchases

- Get spending insights (what, when, where) per month (budgeting tool)

- Set up controls such as location and travel controls (geo-fence spending or create travel alerts), as well as merchant and transaction, spending limits

- Set up alerts to be notified of when, where, and how the card is used

Benefits of our Business Credit Card

Travel – must have purchased all travel related expenses through the card

- Baggage Delay Reimbursement – if baggage is delayed more than four hours, the card will reimburse up to $100/day for up to 3 days

- Accident Insurance – $500,000 max benefit accidental death and dismemberment policy

- Roadside Assistance – for a set price per call, currently $69.95, standard towing, tire change, jump start, lockout service, fuel delivery, winching

- Rental Vehicle Damage Waiver – collision or theft

Cellular Telephone Protection – monthly cell phone bill must be paid through the card

- Damage to or theft of eligible cellular phone will be reimbursed

Purchase Security

- Automatically protects new retail purchases (Regulation E/VISA dispute)